Food and beverage expenses are within the scope of the normal business practice of the eligible entity before the covered period.Suppliers, including protective equipment (PPE) and cleaning materials.

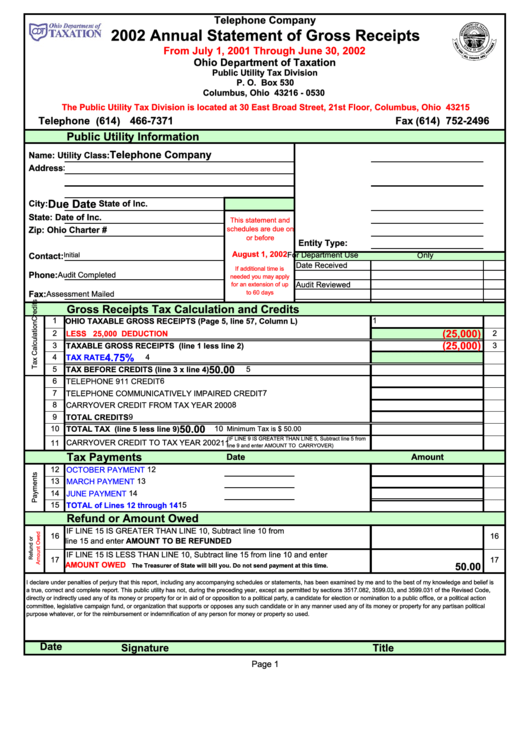

Industry groups are hopeful that the program will launch in May. This program has not launched and SBA has yet to provide any guidance. This program is so new that we don’t even know what the requirements are for it yet.ĭEADLINES: Familiarize yourself with the current forecast of deadlines so that you can have your materials ready when the programs are open to taking applications for your business.Get started NOW! Even though this program isn’t taking applications yet we suggest that if you are interested, then you should start preparing now for your application. ** Taken from on as of yet neither the SBA nor the Treasury Department has set up any guidance resource pages as far as we know. If the entity is not in operation until 2020, it believed you can still receive a grant equal to the amount of “eligible expenses” subtracted by its gross receipts received (or a similar formula from SBA).If the entity is not in operation for the entirety of 2019, then it is believed the calculation will be the difference between 12 times the average monthly gross receipts for 2019 and the average monthly gross receipts in 2020 (or a similar formula from SBA).What if you were in business for all of 2019?.NOTE: The grant amount will be adjusted for the fund amount received through PPP1 and PPP2 programs.(Taken from on as of yet neither the SBA nor the Treasury Department has set up any guidance resource pages as far as we know.) This is believed to be calculated by subtracting its 2020 gross receipts from its 2019 gross receipts. An eligible entity may receive a tax-free federal grant equal to the amount of its pandemic-related revenue loss.

0 kommentar(er)

0 kommentar(er)